METROPOLITAN SERIES FUND, INC.

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| Preliminary Proxy Statement | ||||

| Definitive Proxy Statement | ||||

| ¨ | Definitive Additional Materials | |||

| ¨ | Soliciting Material Pursuant to 240.14a-11(c) or 240.14a-12 | |||

| METROPOLITAN SERIES FUND, INC. | ||||

| (Name of registrant as specified in its charter) | ||||

| Payment of Filing Fee (check the appropriate box): | ||||

| x | No fee required | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| 1) | Title of each class of securities to which transaction applies: | |||

| ||||

| 2) | Aggregate number of securities to which transaction applies: | |||

| ||||

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing is calculated and state how it was determined): | |||

| ||||

| 4) | Proposed maximum aggregate value of transaction: | |||

| ||||

| 5) | Total fee paid: | |||

| ||||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| 1) | Amount previously paid: | |||

| ||||

| 2) | Form, Schedule or Registration Statement No.: | |||

| ||||

| 3) | Filing Party: | |||

| ||||

| 4) | Date Filed: | |||

| ||||

METROPOLITAN SERIES FUND, INC.

501 Boylston Street

Boston, Massachusetts 02116

Dear Contract Holder:

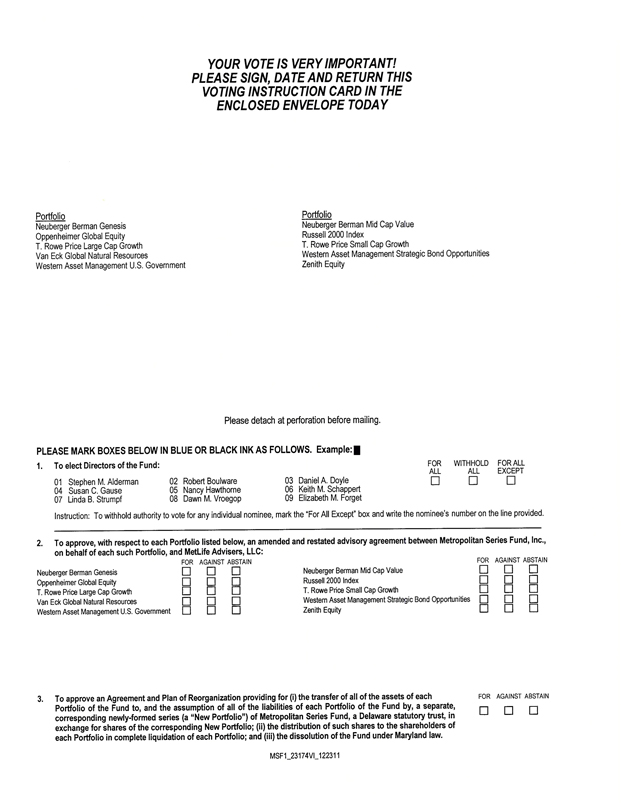

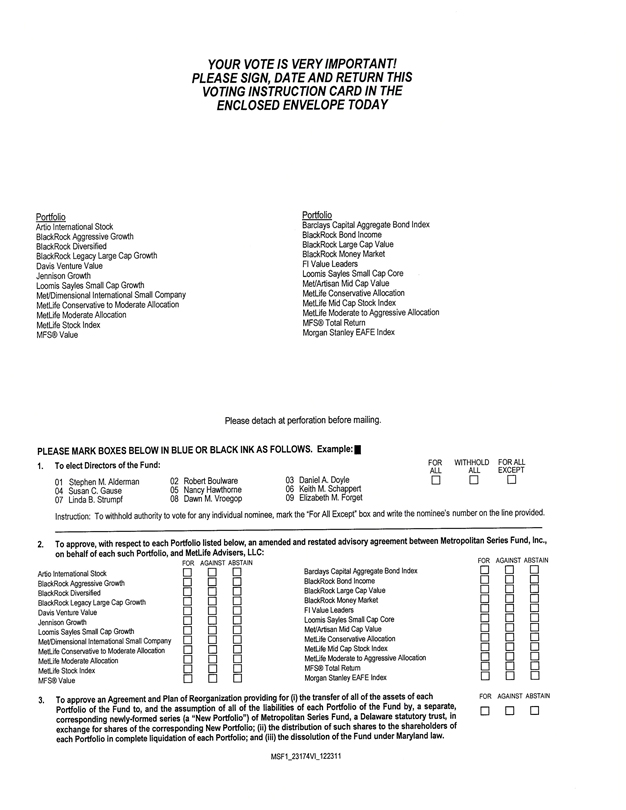

I am writing to ask for your vote on important matters concerning your investment in the series (each, a “Portfolio” and collectively, the “Portfolios”) of Metropolitan Series Fund, Inc. (the “Fund”). The Board of Directors of the Fund (the “Board”) has called a special meeting of shareholders of the Portfolios scheduled for February 24, 2012 at the offices of MetLife Advisers, LLC, 501 Boylston Street, Boston, Massachusetts 02116, at 10:00 a.m. Eastern Time (the “Meeting”). The purpose of the Meeting is to ask shareholders to consider the following important proposals:

(I) To elect Directors of the Fund (“Proposal I”);

(II) To approve for each Portfolio of the Fund an Amended and Restated Advisory Agreement between the Fund, on behalf of such Portfolio, and MetLife Advisers, LLC, the Fund’s investment adviser (the “Manager”) (“Proposal II”); and

(III) To approve an Agreement and Plan of Reorganization (the “Reorganization Agreement”) providing for (i) the transfer of all of the assets of each Portfolio of the Fund to, and the assumption of all of the liabilities of each Portfolio of the Fund by, a separate, corresponding newly-formed series (a “New Portfolio”) of Metropolitan Series Fund, a newly-formed Delaware statutory trust (the “New Trust”), in exchange for shares of the corresponding New Portfolio; (ii) the distribution of such shares to the shareholders of each Portfolio in complete liquidation of the Portfolio; and (iii) the dissolution of the Fund under Maryland law (collectively, the “Reorganization”) (“Proposal III” and, together with Proposal I and Proposal II, the “Proposals”).

In addition, shareholders may be asked to consider and act upon other matters which may properly come before the Meeting or any adjournment or postponement thereof.

In Proposal I, shareholders are asked to elect four (4) new directors and re-elect five (5) existing directors for, among other things, the purpose of substantially aligning the membership of the Board with the board that oversees the other investment company portfolios advised by the Manager (the “MIST Portfolios” and, together with the Portfolios, the “MetLife Funds Complex”). The Board has determined that it would be beneficial to the Fund and that certain efficiencies may inure to the Fund if substantially similar boards were responsible for the oversight of all of the funds in the MetLife Funds Complex given, among other things, the increased similarity between the operations of the Portfolios and the MIST Portfolios and the additional responsibilities imposed on board members generally as a result of recent regulatory developments. If elected, each of the board members, except for me, is expected to qualify as a board member who is not an “interested person” (as defined in the Investment Company Act of 1940, as amended) of the Fund.

In Proposal II, shareholders of each Portfolio are asked to approve an Amended and Restated Advisory Agreement with the Manager for the purpose of revising the terms of that Agreement to reflect, among other things, that the Fund may retain a third party to perform administrative services for each Portfolio at the Portfolio’s expense, and to limit generally the Manager’s role in respect of those administrative services to supervising and overseeing them. Under the Amended and Restated Advisory Agreement for each Portfolio, the Manager would no longer be obligated to provide administrative services to the Portfolios.

If shareholders of a Portfolio approve Proposal II, the Fund expects, at a future date, to retain for the Portfolio a third-party service provider that specializes in providing administrative services to mutual funds. The Manager and Board believe the Portfolios may benefit over the long term from the retention of a third-party administrator dedicated to the business of providing administrative services to mutual fund families. If Proposal II were approved by each Portfolio and a third-party administrator were retained on behalf of the Portfolios, the Manager estimates, based on a preliminary review of the market, that each Portfolio’s total annual operating expenses would increase by less than 0.005% of the Portfolio’s average daily net assets, assuming current asset levels for the funds in the MetLife Funds Complex remain the same and that the entire MetLife Funds Complex retains the same third-party administrator. There can be no assurances that a Portfolio’s total annual operating expenses will not increase by more than the amount shown above.

In addition, with respect to the advisory agreements of the Barclays Capital Aggregate Bond Index Portfolio, Loomis Sayles Small Cap Growth Portfolio, MetLife Mid Cap Stock Index Portfolio, MetLife Stock Index Portfolio, MFS Value Portfolio, Morgan Stanley EAFE Index Portfolio, Neuberger Berman Mid Cap Value Portfolio, Oppenheimer Global Equity Portfolio, Russell 2000 Index Portfolio, T. Rowe Price Large Cap Growth Portfolio and T. Rowe Price Small Cap Growth Portfolio only (collectively, the “Group A Portfolios”), additional amendments are proposed to modernize the terms of the Group A Portfolios’ advisory agreements and to align the terms of the Group A Portfolios’ current advisory agreements with those of the advisory agreements of the other Portfolios of the Fund.

In Proposal III, shareholders are asked to approve the reorganization of the Fund, currently a Maryland corporation, as a Delaware statutory trust. The New Trust expects to adopt the registration statement of the Fund, such that each New Portfolio is expected to have, immediately after the Reorganization, the same investment objectives and policies as the corresponding Portfolio to whose business it will succeed. In addition, each New Portfolio is expected to be managed by the same investment adviser, subadviser (if applicable) and portfolio managers as its corresponding Portfolio. No changes to any of the Portfolios’ expense structures would be expected to result if Proposal III is approved by shareholders. The Manager and Board believe the Fund may benefit from certain flexibility provided by the Reorganization (e.g., the ability to authorize the issuance of an unlimited number of shares) and certain efficiencies that may be achieved by having all of the funds in the MetLife Funds Complex organized as Delaware statutory trusts (e.g., the elimination

of certain legal costs that result from operating a family of funds that does not have uniform organizational documents).

After careful consideration, the Board unanimously recommends that you vote “FOR” each Proposal.

A Notice of Special Meeting of Shareholders is enclosed, followed by a proxy statement relating to the Proposals (the “Proxy Statement”). Please review the enclosed Proxy Statement for a more detailed description of the Proposals.

As an owner of a variable life insurance policy or variable annuity contract issued by separate accounts of Metropolitan Life Insurance Company and its insurance company affiliates (collectively, the “Insurance Companies”), you have the right to instruct your Insurance Company how to vote at the Meeting on the Proposals. You may give voting instructions for the number of shares of the relevant Portfolio(s) attributable to your life insurance policy or annuity contract as of the record time at the close of business on November 30, 2011.

Your vote is very important to us regardless of the number of shares attributable to your variable life insurance policy or variable annuity contract. Whether or not you plan to attend the Meeting in person, pleasePlease read the Proxy Statement and cast your vote promptly. It is important that your vote bereceived by no later than the time of the Meeting on February 24, 2012. VOTING IS QUICK AND EASY. EVERYTHING YOU WILL REQUIRE IS ENCLOSED. To cast your vote simply complete, sign and return the Voting Instruction Card in the enclosed postage-paid envelope. As an alternative to voting by mail you may also vote either via the Internet or by telephone, as explained on the Voting Instruction Card. You may still vote in person if you attend the Meeting.

We encourage you to vote via the Internet or by telephone using the control number that appears on your enclosed Voting Instruction Card. Use of Internet or telephone voting will reduce the time and costs associated with this proxy solicitation.

If you have any questions after considering the enclosed materials, please call your financial representative.

Sincerely,

Elizabeth M. Forget

President

METROPOLITAN SERIES FUND, INC.

Artio International Stock Portfolio

Barclays Capital Aggregate Bond Index Portfolio

BlackRock Aggressive Growth Portfolio

BlackRock Bond Income Portfolio

BlackRock Diversified Portfolio

BlackRock Large Cap Value Portfolio

BlackRock Legacy Large Cap Growth Portfolio

BlackRock Money Market Portfolio

Davis Venture Value Portfolio

FI Value Leaders Portfolio

Jennison Growth Portfolio

Loomis Sayles Small Cap Core Portfolio

Loomis Sayles Small Cap Growth Portfolio

Met/Artisan Mid Cap Value Portfolio

Met/Dimensional International Small Company Portfolio

MetLife Conservative Allocation Portfolio

MetLife Conservative to Moderate Allocation Portfolio

MetLife Mid Cap Stock Index Portfolio

MetLife Moderate Allocation Portfolio

MetLife Moderate to Aggressive Allocation Portfolio

MetLife Stock Index Portfolio

MFS® Total Return Portfolio

MFS® Value Portfolio

Morgan Stanley EAFE Index Portfolio

Neuberger Berman Genesis Portfolio

Neuberger Berman Mid Cap Value Portfolio

Oppenheimer Global Equity Portfolio

Russell 2000 Index Portfolio

T. Rowe Price Large Cap Growth Portfolio

T. Rowe Price Small Cap Growth Portfolio

Van Eck Global Natural Resources Portfolio

Western Asset Management Strategic Bond Opportunities Portfolio

Western Asset Management U.S. Government Portfolio

Zenith Equity Portfolio

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

Notice is hereby given that a Special Meeting (the “Meeting”) of the shareholders of Metropolitan Series Fund, Inc. (the “Fund”) and each series of the Fund (each, a “Portfolio” and, collectively, the “Portfolios”) will be held at 10:00 a.m. Eastern Time on February 24, 2012, at the offices of MetLife Advisers, LLC (the “Manager”), 501 Boylston Street, Boston, Massachusetts 02116 for the following purposes:

| 1. | To elect Directors of the Fund. |

| 2. | To approve an Amended and Restated Advisory Agreement between the Fund, on behalf of each Portfolio, and the Manager. |

| 3. | To approve an Agreement and Plan of Reorganization providing for (i) the transfer of all of the assets of each Portfolio of the Fund to, and the assumption of all of the liabilities of each Portfolio of the Fund by, a separate, corresponding newly-formed series (a “New Portfolio”) of Metropolitan Series Fund, a Delaware statutory trust, in exchange for shares of the corresponding New Portfolio; (ii) the distribution of such shares to the shareholders of each Portfolio in complete liquidation of each Portfolio; and (iii) the dissolution of the Fund under Maryland law. |

In addition, shareholders may be asked to consider and act upon other matters which may properly come before the Meeting or any adjournment or postponement thereof.

Shareholders of record at the close of business on the record date, November 30, 2011, are entitled to notice of and to vote at the Meeting and any adjourned or postponed session thereof.

By order of the Board of Directors of the Fund,

Michael P. Lawlor, Assistant Secretary

[ ],December 30, 2011

NOTICE: YOUR VOTE IS IMPORTANT. PLEASE FILL IN, DATE, SIGN AND RETURN THE ENCLOSED VOTING INSTRUCTION CARD PROMPTLY IN THE ENCLOSED POSTAGE-PAID ENVELOPE WHETHER OR NOT YOU PLAN TO BE PRESENT AT THE MEETING. YOU CAN ALSO VOTE VIA THE INTERNET OR BY TELEPHONE BY FOLLOWING THE SIMPLE INSTRUCTIONS THAT APPEAR ON THE ENCLOSED VOTING INSTRUCTION CARD. YOU MAY STILL VOTE IN PERSON IF YOU ATTEND THE MEETING.

METROPOLITAN SERIES FUND, INC.

501 Boylston Street

Boston, Massachusetts 02116

Artio International Stock Portfolio

Barclays Capital Aggregate Bond Index Portfolio

BlackRock Aggressive Growth Portfolio

BlackRock Bond Income Portfolio

BlackRock Diversified Portfolio

BlackRock Large Cap Value Portfolio

BlackRock Legacy Large Cap Growth Portfolio

BlackRock Money Market Portfolio

Davis Venture Value Portfolio

FI Value Leaders Portfolio

Jennison Growth Portfolio

Loomis Sayles Small Cap Core Portfolio

Loomis Sayles Small Cap Growth Portfolio

Met/Artisan Mid Cap Value Portfolio

Met/Dimensional International Small Company Portfolio

MetLife Conservative Allocation Portfolio

MetLife Conservative to Moderate Allocation Portfolio

MetLife Mid Cap Stock Index Portfolio

MetLife Moderate Allocation Portfolio

MetLife Moderate to Aggressive Allocation Portfolio

MetLife Stock Index Portfolio

MFS® Total Return Portfolio

MFS® Value Portfolio

Morgan Stanley EAFE Index Portfolio

Neuberger Berman Genesis Portfolio

Neuberger Berman Mid Cap Value Portfolio

Oppenheimer Global Equity Portfolio

Russell 2000 Index Portfolio

T. Rowe Price Large Cap Growth Portfolio

T. Rowe Price Small Cap Growth Portfolio

Van Eck Global Natural Resources Portfolio

Western Asset Management Strategic Bond Opportunities Portfolio

Western Asset Management U.S. Government Portfolio

Zenith Equity Portfolio

1

PROXY STATEMENT

This Proxy Statement is being furnished in connection with the solicitation of voting instructions by the Board of Directors (the “Board of Directors,” the “Board,” or the “Directors”) of Metropolitan Series Fund, Inc. (the “Fund”) for use at the special meeting (the “Meeting”) of shareholders of the Fund and each of the Fund’s series (each, a “Portfolio” and, collectively, the “Portfolios”). The Meeting will be held at 10:00 a.m. Eastern Time on February 24, 2012, at the offices of MetLife Advisers, LLC, 501 Boylston Street, Boston, Massachusetts 02116. This Proxy Statement and its enclosures are being mailed to shareholders of the Portfolios beginning on or about January 3,6, 2012. Shareholders of record at the close of business on November 30, 2011 (the “Record Date”) are entitled to vote on the proposals, as set forth below.

THE PROPOSALS

As described in greater detail below, this Proxy Statement relates to proposalsproposals:

(i) to (i) elect Directors of the Fund for the purpose of, among other things, substantially aligning the membership of the Board with the board that oversees the other portfolios in the MetLife Funds Complex (as defined below) (“Proposal I”);

(ii) to approve for each Portfolio of the Fund an Amended and Restated Advisory Agreement between the Fund, on behalf of such Portfolio, and MetLife Advisers, LLC, the Fund’s investment adviser (the “Manager”) (“Proposal II”); and

(iii) to approve an Agreement and Plan of Reorganization (the “Reorganization Agreement”) providing for (a) the transfer of all of the assets of each Portfolio of the Fund to, and the assumption of all of the liabilities of each Portfolio of the Fund by, a separate, corresponding newly-formed series (a “New Portfolio”) of Metropolitan Series Fund, a newly formed Delaware statutory trust (the “New Trust”), in exchange for shares of the corresponding New Portfolio; (b) the distribution of such shares to the shareholders of each Portfolio in complete liquidation of each Portfolio; and (c) the dissolution of the Fund under Maryland law (collectively, the “Reorganization”) (“Proposal III” and, together with Proposal I and Proposal II, the “Proposals”).

With respect to Proposals I and III, the shareholders of the Portfolios will vote together as a single class. With respect to Proposal II, the shareholders of each Portfolio will vote separately. The approval and implementation of any one of the Proposals is not contingent on the approval of any of the other Proposals.

INTRODUCTION

The Fund, an open-end management investment company, is a Maryland corporation that was formed in 1982. The Fund is a series-type company with 34 separate series (or “Portfolios”).series. The Manager advises a number of other investment companies (thethat are series of a separate entity (such other investment companies, the “MIST Portfolios” and together with the Portfolios, the “MetLife Funds Complex”) that are series of a separate entity, ,

2

Met Investors Series Trust (“MIST”), formed as a Delaware statutory trust. At a meeting of the Fund’s Board on

2

August 18, 2011 (the “August Meeting”), the Manager introduced a number of proposals to the Board that were intended to align more closely the operations of the Portfolios and the MIST Portfolios. The Manager proposed (i) aligning substantially the membership of the Board with the membership of the Board of Trustees of MIST (the “MIST Board” or the “MIST Trustees”) by electing certain of the MIST Trustees to serve on the Fund’s Board; (ii) amending each Portfolio’s existing advisory agreement for the purpose of revising the terms of those agreements to reflect that the Fund may retain a third party to perform administrative services for each Portfolio at such Portfolio’s expense, and to limit the Manager’s role in respect of those administrative services to supervising and overseeing them; and (iii) reorganizing the Fund as a Delaware statutory trust.

The Board formed a Special Ad Hoc Committee (the “Special Committee”), comprised solely of Directors of the Fund who are not “interested persons” (as defined in the Investment Company Act of 1940, as amended (the “1940 Act”)) of the Fund (“Independent Directors”) to evaluate the proposals made by the Manager at the August Meeting. The Special Committee held its first meeting on August 18, 2011 during which it considered, among other things, the information it would need to evaluate the Manager’s proposals.

Over the following three months, the Special Committee met in person and by phone several more times to discuss and evaluate information provided by the Manager in respect of the proposals; provide comments on the materials and information provided by the Manager regarding the proposals; review and discuss the experience and qualifications of the MIST Trustees under consideration to be nominated to the Fund’s Board; and request, where necessary, additional information from the Manager. During that period, members of the Special Committee also attended a meeting of the MIST Board and met separately with the Trustees of MIST who are not “interested persons” (as defined in the 1940 Act) of MIST.

On November 10, 2011, the Special Committee met to review and discuss an additional proposal from the Manager to align substantially the advisory agreements of each of the Portfolios and, as part of that proposal, to modernize the terms of certain of the Portfolios’ advisory agreements.

Throughout its review of the proposals, the Special Committee was advised by counsel to the Fund and separate counsel to the Independent Directors.

At a meeting of the Fund’s Board on November 16-17, 2011 (the “November Meeting”), the Manager made a revised presentation regarding each of the Proposals.proposals introduced at the August Meeting and the November 10, 2011 Meeting. Based upon the unanimous recommendation of the Special Committee and the Board’s own review of the Proposals,proposals, the Board approved a form of Amended and Restated Advisory Agreement between the Fund, on behalf of each Portfolio, and the Manager (the “Amended

3

“Amended Advisory Agreement”) and the Reorganization Agreement. Acting on nominations made by the Board’s Nominating Committee, the Fund’s Board approved

3

the nominations of Messrs. Stephen M. Alderman, Robert Boulware and Daniel A. Doyle and Ms. Susan C. Gause, each currently a MIST Trustee, to the Fund’s Board. In addition, the Board determined to seek the re-election of Mses. Nancy Hawthorne, Linda B. Strumpf, Dawn M. Vroegop and Elizabeth M. Forget and Mr. Keith M. Schappert by shareholders of the Fund. The Board also called a shareholder meeting for the purpose of asking shareholders to act on the Proposals.

If elected, any newly elected directors will join the Fund’s Board and, if approved, any Amended Advisory Agreement willis expected to become effective as to the Portfolios approving it on or about April 30, 2012. The reorganization of the Fund, if approved, is expected to close on April 30, 2012, although the date may be adjusted in accordance with the Reorganization Agreement.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE SHAREHOLDERS VOTE “FOR” PROPOSALS I, II AND III.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to Be Held on February 24, 2012.

This proxy statement and each Portfolio’s most recent reports to shareholders are available at www.metlife.com/msf.

4

PROPOSAL I – ELECTION OF BOARD MEMBERS

The Fund’s Board is recommending that shareholders elect the following persons as Directors of the Fund: Stephen M. Alderman, Robert Boulware, Daniel A. Doyle and Susan C. Gause (the “New Nominees”), such elections to be effective on or about April 30, 2012, and re-elect Nancy Hawthorne, Keith M. Schappert, Linda B. Strumpf, Dawn M. Vroegop and Elizabeth M. Forget (the “Director Nominees,” and together with the New Nominees, the “Nominees”) as Directors of the Fund. The Board is recommending the election of the New Nominees, each of whom currently serves as a Trustee on the MIST Board (as do Mses. Forget and Vroegop), for the purposes of, among other things, substantially aligning the members of the Board with the membership of the MIST Board, which is the board that oversees the MIST Portfolios. If elected, each of the Nominees, except Ms. Forget, is expected to qualify as an Independent Director of the Fund. Ms. Forget is an “interested person” of the Fund (as defined in the 1940 Act) because of her position as President of the Manager and her positions with certain other affiliatesownership of securities issued by MetLife, Inc. (“MetLife”), the ultimate parent company of the Manager, and her ownership of securities issued by MetLife.Manager.

Over the past several months, representatives of the Fund’s Board participated in informal and formal meetings with the Manager, counsel to the Fund and counsel to the Board’s Independent Directors to review and discuss ways to coordinate and enhance the governance of the MetLife Funds Complex, given, among other things, the increased similarity between the operations of the Portfolios and the MIST Portfolios and the additional responsibilities imposed on board members generally as a result of recent regulatory developments. Among the subjects considered by the Board was the possible substantial alignment of the memberships of the Board and the MIST Board. The Board considered the potential benefits of such an alignment, including, among other things, (i) the potential for enhanced board oversight of portfolio operations throughout the MetLife Funds Complex; (ii) the potential for further uniformity of practices throughout the MetLife Funds Complex; (iii) the potential for key personnel of the Manager to oversee Fund operations more efficiently by enabling them to address matters concerning both Boards simultaneously; and (iv) the potential for operational efficiencies by, for example, decreasing the time dedicated to preparing for and holding multiple regular board meetings each calendar quarter.

After extensive discussions and meetings, the Nominating Committee of the Board, composed exclusively of boardBoard members of the Fund who are Independent Directors, determined that it would be beneficial to the Fund if substantially similar boards were responsible for overseeing the operations of the entire MetLife Funds Complex. Throughout these discussions the Nominating Committee of the Board was advised by counsel to the Independent Directors.

At the November Meeting, the Nominating Committee of the Board determined to recommend to the full Board the New Nominees for election to the Board and the Director Nominees for re-election to the Board. Acting on that recommendation at the

5

November Meeting, the Board approved those nominations and called a meeting of

5

shareholders to allow shareholders of the Fund to vote on the election and re-election, respectively, of the New Nominees and the Director Nominees to the Board.

To further align the boards that oversee the operations of the MetLife Funds Complex, the Manager has informed the Fund that the MIST Board expects to ask shareholders of MIST to elect each of the Director Nominees who do not already serve as members of the MIST Board as Trustees of MIST effective on or about April 30, 2012.

Information about each Nominee is set forth below. If elected by the shareholders of the Fund, it is expected that each Nominee would serve on the Board and, subject to MIST shareholder approval, on the MIST Board.

Information Concerning Nominees, Directors and Executive Officers

The following table provides information concerning the Nominees for election or re-election by shareholders, current Directors not proposed for re-election to the Board, and the executive officers of the Fund. Unless otherwise noted, (i) each Nominee, current Director and officer has engaged in the principal occupation(s) noted in the table for at least the most recent five years, although not necessarily in the same capacity and (ii) the address of the current Directors and officers of the Fund is c/o Metropolitan Series Fund, Inc., 501 Boylston Street, Boston, MA 02116, and the address of the New Nominees is c/o Met Investors Series Trust, 5 Park Plaza, Suite 1900, Irvine, California 92614.

Mr. Ludes, a current Director, is expected to retire at the end of the 2011 calendar year. Messrs. Garban, Scott Morton and Typermass are expected to retire from the Fund’s Board either before or at the time the New Nominees, if elected, join the Board. Following their retirement from the Board, Messrs. Garban and Scott Morton are expected to serve as Directors Emeriti to the Board and will commit to attend meetings of the Board, if requested by the Independent Directors, and will remain available for consultation by the Independent Directors of the Fund until December 31, 2012. As compensation for their service, each Director Emeritus will receive the pro rated portion of the retainer they would have received had they remained on the Board through December 31, 2012.

Each New Nominee elected and each Director Nominee re-elected to the Board at the Meeting will serve until his or her successor has been elected and qualified, or until he or she dies, resigns or is removed. Each Nominee has indicated a willingness to serve if elected.

6

Name and Age | Position(s) | Term of | Principal | Number of | Other | |||||

Nominees | ||||||||||

Stephen M. Alderman (52) | Nominee | N/A | Since November 1991, Shareholder in the law firm of Garfield and Merel, Ltd. | 88 | Since December 2000, | |||||

Robert Boulware (55) | Nominee | N/A | From 2004 to 2009, Director, Norwood Promotional Products, Inc.; from 2007 to 2008, Director, Wealthpoint Advisors (a business development company); from 2007 to 2009, Director, Holladay Bank; from | 88 | Since March 2008, | |||||

7

Name and Age | Position(s) | Term of | Principal | Number of | Other | |||||

Daniel A. Doyle, CFA (53) | Nominee | N/A | Since November 2011, | 88 | Since February 2007, | |||||

Susan C. Gause (59) | Nominee | N/A | 88 | Since March 2008, | ||||||

8

Name and Age | Position(s) | Term of | Principal | Number of | Other | |||||

Nancy Hawthorne (60) | Director and Nominee | Indefinite; From 2003 to present | Since 1997, Chief Executive Officer, Clerestory LLC (corporate | 88 | Since 2009, Director, |

9

Name and Age | Position(s) | Term of | Principal | Number of | Other | |||||

Keith M. Schappert (60) | Director and Nominee | Indefinite; From 2009 to present | 88 | Since December 2009, Director, The Commonfund for Nonprofit Organizations; since December 2009, Director, Trilogy Global Advisors; |

10

Name and Age | Position(s) | Term of | Principal | Number of | Other | |||||

Linda B. Strumpf, CFA (64) | Director and Nominee | Indefinite; From 2000 to present | ||||||||

| Foundation; from 1982 to December 1992, Director of Equity Investments, Ford Foundation; formerly, Vice President and | 88 | Since | |||||||

| ||||||||||

| ||||||||||

11

Name and Age | Position(s) | Term of | Principal | Number of | Other | |||||

Dawn M. Vroegop (45) | Director and Nominee | Indefinite; From 2009 to present | From September 1999 to September 2003, Managing Director, Dresdner RCM Global Investors. | 88 | Since December 2000, Trustee, MIST**; since 2003, Director and Investment Committee Chair, City College of San Francisco Foundation. | |||||

Interested Director and Nominee | ||||||||||

Elizabeth M. Forget* (45) | President, Director and Nominee | Indefinite; From 2006 to present | Since May 2007, Senior Vice President, MetLife, Inc.; since December 2000, President, MetLife Advisers, LLC and a predecessor company; from July 2000 to April 2007, Vice President, MetLife. | 88 | Since December 2000, Trustee, MIST**; various MetLife-affiliated boards. | |||||

Independent Directors | ||||||||||

Steve A. Garban (74) | Director | Indefinite; From 1985 to present | Formerly, Chief Financial Officer, Senior Vice President Finance and Operations and Treasurer Emeritus, The Pennsylvania State University. | 34 | Chairman of the Board of Trustees, The Pennsylvania State University. | |||||

| ||||||||||

| ||||||||||

12

Name and Age | Position(s) | Term of | Principal | Number of | Other | |||||

John T. Ludes (75) | Director | Indefinite; From 2003 to present | President, LFP Properties (consulting firm); formerly, Vice Chairman, President and Chief Operating Officer, Fortune Brands/American Brands (global conglomerate); formerly, President and CEO, Acushnet Company (athletic equipment company). | 34 | None | |||||

Michael S. Scott Morton (74) | Director | Indefinite; From 1993 to present | Jay W. Forrester Professor of Management (Emeritus), Sloan School of Management, Massachusetts Institute of Technology. | 34 | None | |||||

Interested Director | ||||||||||

Arthur G. Typermass* (74) | Director | Indefinite; From 1998 to present | Formerly, Senior Vice President and Treasurer, MetLife. | 34 | None | |||||

13

Executive Officers

Name and Age | Position(s) | Length of | Principal | |||

Jeffrey L. Bernier (40) | Senior Vice President | From February 2008 to present | Since December 2007, Vice President, | |||

Peter H. Duffy (55) | Vice President and Treasurer | From 2000 to present | Since 2001, Senior Vice President, MetLife Advisers; | |||

Jeffrey P. Halperin (43) | Chief Compliance Officer | From November 2005 to present | Since March 2006, Vice President, MetLife; since August 2006, Chief Compliance Officer, MIST; since February 2008, Chief Compliance Officer, Metropolitan Series Fund, Inc.; from November 2005 to February 2008, Interim Chief Compliance Officer, Metropolitan Series Fund, Inc.; since August 2006, Chief Compliance Officer, MetLife Advisers, LLC and a predecessor | |||

1314

Name and Age | Position(s) | Length of | Principal | |||

Alan C. Leland (59) | Senior Vice President | From 2005 to present | Treasurer and Chief Financial Officer, MetLife Advisers, LLC; Vice President, MetLife Group, Inc; Vice President, MetLife; Senior Vice President, | |||

Andrew L. Gangolf (57) | Secretary | From 2011 to present | Since March 2011, Senior Vice President, MetLife Advisers, LLC; from 1996 until 2011, Senior Vice President & Assistant General Counsel, | |||

| * | Ms. Forget is an “interested person” of the Fund because of her positions with the Manager |

| ** | Indicates a directorship with a registered investment company or a company subject to the reporting requirements of the Securities Exchange Act of 1934, as amended. |

| (1) | Previous positions during the past five years with the Fund, MetLife, the Manager, |

| (2) | The MetLife Funds Complex includes 34 portfolios, each a series of the Fund, and 54 portfolios, each a series of MIST. The number indicated assumes that all of the Nominees will serve on the Boards of both the Fund and MIST on or about April 30, 2012. |

If, prior to the Meeting, any Nominee becomes unable to serve for any reason, the persons named as proxies reserve the right to substitute another person or persons of their choice as Nominee(s). All of the Nominees have consented to being named in this proxy statement and to serve if elected. The Fund knows of no reason why any Nominee would be unable or unwilling to serve if elected.

Each of the New Nominees was originally recommended to serve on the Fund’s Board by the Manager or a predecessor company.

15

Qualifications of Nominees and Current Directors

The following provides an overview of the considerations that led the Board to conclude that each individual serving as a Director of the Fund should so serve, and in the case of the Nominees, that each Director Nominee and New Nominee should be proposed for re-election or election, respectively, to the Board. The current members of the Board have joined the Board at different points in time since 1985. Generally, no one factor was decisive in the original selection of an individual to join the Board. Among the factors the Board considers when concluding that an individual should serve on the Board are the following: (i) the individual’s business and professional

14

experience and accomplishments, including prior experience in the financial services and investment management fields or on other boards; (ii) the individual’s ability to work effectively with the other members of the Board; (iii) experience, if any, on boards of other investment companies that were merged into the Fund; and (iv) how the individual’s skills, experiences and attributes would contribute to an appropriate mix of relevant skills and experience on the Board.

In respect of each current Director and Nominee, the individual’s substantial professional accomplishments and prior experience, including, in some cases, in fields related to the operations of the Fund, were a significant factor in the determination that the individual should serve as a Director of the Fund. Each current Director’s and Nominee’s recent prior professional experience is summarized in the table above.

Independent Directors.In certain cases, additional considerations contributed to the Board’s conclusion that an individual should serve on the Board. For example, the Board considered each of the following in concluding that the individual should serve as a current Director of the Fund: Mr. Ludes’ and Ms. Hawthorne’s prior experience serving on the Board of Directors of New England Zenith Fund, which combined its operations with those of the Fund in 2003, and the continuity of oversight of the acquired operations that they would provide as Directors of the Fund; Ms. Vroegop’s experience serving as a trustee of MIST; Ms. Forget’s leadership roles with the Manager and the Fund; Mr. Typermass’ professional experience as Senior Vice President and Treasurer of the Fund’s sponsoring insurance company; Mr. Garban’s extensive experience in audit, finance and investments as well as service on other boards; Ms. Strumpf’s extensive investment experience; Dr. Scott Morton’s distinguished career in the teaching of business administration, related research and service on corporate boards; Mr. Ludes’ substantial general management experience; Ms. Hawthorne’s experience in leadership positions with publicly traded companies; and Ms. Vroegop’s and Mr. Schappert’s substantial experience as executives in the investment management industry with entities unaffiliated with the Manager.

Interested Directors.With respect to the Directors of the Fund who are Interested Directors, the following additional considerations contributed to the Board’s conclusion that they should serve on the Board: Ms. Forget’s leadership roles with the Manager and the Fund and Mr. Typermass’ professional experience as Senior Vice President and Treasurer of the Fund’s sponsoring insurance company.

New Nominees.In respect of the New Nominees, the Board also considered their years of service as trustees of MIST, including any service on a committee of the

16

MIST Board, as well as their knowledge of the operations and business of MIST. In certain cases, additional considerations contributed to the Board’s conclusion that an individual should serve on the Board. For example, Mr. Alderman’s five years of experience serving as the lead Independent Trustee of MIST and his professional experience as a practicing attorney; Mr. Boulware’s significant experience in leadership positions in the financial services industry; Mr. Doyle’s significant public accounting experience; and Ms. Gause’s significant experience in the investment management and financial services industry.

The Fund’s Directors review actions of the Fund’s investment adviser and subadvisers, and decide upon matters of general policy. The Fund’s officers supervise the daily business operations of the Fund. Each Director is, and each New Nominee if elected will be, responsible for overseeing all 34 Portfolios of the Fund. There is no

15

limit to the term a Director may serve; however, the Fund has adopted a retirement policy which generally requires Directors to retire as of December 31 of the year in which such Director attains the age of 75. Each Director serves until his or her successor has been elected and qualified, or until he or she dies, resigns or is removed.

Board Leadership Structure and Risk Oversight

The following describes the current Board leadership structure. If Proposal I is approved, the leadership structure of the Board and the structure, composition, types and/or number of the Fund’s standing Committees may change.

The Board consists of nine Directors, seven of whom are Independent Directors. The Chair of the Board, Ms. Elizabeth M. Forget, also serves as President and Chief Executive Officer of the Fund, and President, Chief Executive Officer and Chair of the Board of Managers of the Manager, and as such she participates in the oversight of the Fund’s day-to-day business affairs. Ms. Forget is an “interested person” of the Fund.

The Independent Directors have elected Mr. Steve A. Garban to serve as the lead Independent Director of the Board. Ms. Forget communicates and consults with Mr. Garban regularly on various issues involving the management and operations of the Fund. A portion of each regular meeting of the Board is devoted to an executive session of the Independent Directors at which no members of management are present. At those meetings, the Independent Directors consider a variety of matters that are required by law to be considered by the Independent Directors, as well as matters that are scheduled to come before the full Board, including fund governance and leadership issues, and are advised by separate, independent legal counsel. Mr. Garban serves as Chair for those meetings.

As described below, the Board conducts much of its work through certain standing Committees, each of which is chaired by an Independent Director. The Board has not established a formal risk oversight committee. However, much of the regular work of the Board and its standing Committees addresses aspects of risk oversight. The Board had four regularly scheduled meetings in 2010. Each Director attended at least

17

75% of the aggregate number of all meetings of the Board and at least 75% of the aggregate number of all Board committee meetings on which the Director served.

The Board has delegated certain authority to an Audit Committee, which consists of Messrs. Garban, Ludes and Schappert, Dr. Scott Morton and Mses. Hawthorne, Strumpf and Vroegop, all of whom are Independent Directors. The Board has determined that three of the Audit Committee members qualify as Audit Committee Financial Experts. The Audit Committee reviews the Fund’s financial and accounting controls and procedures, recommends the selection of the Fund’s independent registered public accounting firm, reviews the scope of the Fund’s audit, reviews the Fund’s financial statements and audit reports, reviews the independence of the Fund’s independent registered public accounting firm and approves fees and assignments

16

relating to both audit and non-audit activities of the independent registered public accounting firm. Ms. Strumpf serves as Chair of the Audit Committee. The Board has adopted a written charter relating to the operation of the Audit Committee.

The Board has established two Contract Review Committees of the Board, each of which has responsibilities relating to designated Portfolios of the Fund. One Contract Review Committee is comprised of Messrs. Garban, Ludes and Schappert and Ms. Strumpf. Mr. Ludes currently serves as Chair of that Contract Review Committee. The other Contract Review Committee is comprised of Dr. Scott Morton, Mr. Typermass and Mses. Hawthorne and Vroegop. Ms. Hawthorne currently serves as Chair of that Contract Review Committee. Each Contract Review Committee from time to time reviews and makes recommendations to the Board as to contracts that require approval of a majority of the Independent Directors, which are assigned to such Contract Review Committee by the Board, and any other contracts that may be referred to it by the Board. The Board generally considers each Portfolio’s advisory and principal underwriting agreements at least annually.

The Board has established a Governance Committee, which consists of Messrs. Garban, Ludes, Schappert and Typermass, Dr. Scott Morton and Mses. Hawthorne, Strumpf and Vroegop. Dr. Scott Morton currently serves as Chair of the Governance Committee. The Governance Committee reviews periodically Board governance practices, procedures and operations, the size and composition of the Board of Directors, Director compensation and other matters relating to the governance of the Fund.

The Board has established a Nominating Committee of the Board, which consists of Messrs. Garban, Ludes and Schappert, Dr. Scott Morton and Mses. Hawthorne, Strumpf and Vroegop, all of whom are Independent Directors. Dr. Scott Morton currently serves as Chair of the Nominating Committee. The Nominating Committee evaluates the qualifications of the Fund’s candidates for Independent Director positions and makes recommendations to the Independent Directors with respect to nominations for Independent Director membership on the Fund’s Board. The Nominating Committee considers Independent Director candidates in connection with Board vacancies and newly created Board positions. The Nominating Committee requires that

18

Independent Director candidates have a college degree or equivalent business experience.

The Nominating Committee may take into account a wide variety of factors in considering Independent Director candidates, including (but not limited to): (i) availability and commitment of a candidate to attend meetings and perform his or her responsibilities on the Fund’s Board, (ii) relevant industry and related experience, (iii) educational background, (iv) ability, judgment and expertise and (v) overall diversity of the Board’s composition. The Nominating Committee takes the overall diversity of the Board into account when considering and evaluating Independent Director candidates. While the Nominating Committee has not adopted a specific policy on diversity or a particular definition of diversity, when considering candidates,

17

the Nominating Committee generally considers the manner in which each candidate’s professional experience, background, skills in matters that are relevant to the oversight of the Portfolios (e.g., investment management, distribution, accounting, trading, compliance, legal), and general leadership experience are complementary to the existing Directors’ attributes. The Nominating Committee Charter is attached asAppendix A to this Proxy Statement.

The Nominating Committee will consider candidates for Independent Directors recommended by owners (“Contract Owners”) of a variable life insurance policy or variable annuity contract (a “Contract”) issued by separate accounts of Metropolitan Life Insurance Company (“Metropolitan Life”) or other affiliated insurance companies (each an “Insurance Company” and, collectively, the “Insurance Companies”), and evaluate such candidates in the same manner as it considers and evaluates candidates recommended by other sources. The Board has adopted procedures that a Contract Owner must follow to submit properly a recommendation to the Nominating Committee. Recommendations must be in a writing submitted to the Fund’s Secretary, c/o MetLife Advisers, LLC, 501 Boylston Street, Boston, MA 02116, and must include: (i) a statement in writing setting forth (A) the name, age, date of birth, business address, residence address and nationality of the person recommended by the Contract Owner (the “candidate”); (B) the number of units that relate to shares of each Portfolio (and class) of the Fund attributable to any annuity or life insurance contract of the candidate, as reported to such Contract Owner by the candidate; (C) any other information regarding the candidate called for with respect to director nominees by paragraphs (a), (d), (e) and (f) of Item 401 of Regulation S-K or paragraph (b) of Item 22 of Rule 14a-101 (Schedule 14A) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”); (D) any other information regarding the candidate that would be required to be disclosed if the candidate were a nominee in a proxy statement or other filing required to be made in connection with the election of Independent Directors pursuant to Section 14 of the Exchange Act and the rules and regulations promulgated thereunder; and (E) information regarding the candidate that will be sufficient for the Fund to make a determination as to whether the candidate is or will be an “interested person” of the Fund (as defined in the 1940 Act); (ii) the written and signed consent of the candidate to be named as a nominee and to serve as an Independent Director if elected; (iii) the name of the recommending Contract

19

Owner as it appears on the books of the relevant Insurance Company separate account; (iv) the number of units that relate to shares of each Portfolio (and class) of the Fund attributable to any annuity or life insurance contract of such recommending Contract Owner; and (v) a description of all arrangements or understandings between the recommending Contract Owner and the candidate and any other person or persons (including their names) pursuant to which the recommendation is being made by the recommending Contract Owner. In addition, the Nominating Committee may require the candidate to furnish such other information as it may reasonably require or deem necessary to determine the eligibility of such candidate to serve on the Board or to satisfy applicable law. The Nominating Committee accepts recommendations on a continuous basis.

18

During 2010, the Audit Committee met three times, each Contract Review Committee met one time and the Governance Committee met five times. The Nominating Committee did not meet.

The Fund has retained the Manager as the Fund’s investment adviser and administrator. The Manager is responsible for the day-to-day administration of the Fund and, except in the cases of the Zenith Equity Portfolio and the MetLife Conservative Allocation Portfolio, the MetLife Conservative to Moderate Allocation Portfolio, the MetLife Moderate Allocation Portfolio and the MetLife Moderate to Aggressive Allocation Portfolio (collectively, the “Asset Allocation Portfolios”), has delegated the day-to-day management of the investment activities of each Portfolio of the Fund to that Portfolio’s subadviser. Each subadviser is primarily responsible for the management of the risks that arise from the Portfolio’s investments. The Manager is primarily responsible for the rest of the Fund’s operations and for supervising the services provided to the Fund by each subadviser, including risk management. The Board provides oversight of the services provided by the Manager and each subadviser, including the risk management and oversight services provided by the Manager. In the course of providing that oversight, the Board receives a wide range of reports on the Fund’s activities from the Manager and the subadvisers, including regarding each Portfolio’s investment portfolio, the compliance of the Portfolio with applicable laws, and the Portfolio’s financial accounting and reporting. The Board also meets periodically with the Fund’s Chief Compliance Officer to receive reports regarding the compliance of each Portfolio with the federal securities laws and the Fund’s internal compliance policies and procedures. The Board also meets with the Fund’s Chief Compliance Officer at least annually to review the Chief Compliance Officer’s annual report, including the Chief Compliance Officer’s risk-based analysis for the Fund. The Board also meets periodically with the portfolio managers of each Portfolio to receive reports regarding the management of the Portfolio, including its investment risks. The Board reviews this risk oversight approach as a part of its annual self-evaluation.

The Board periodically reviews its leadership structure, including the role of the Chair and the lead Independent Director. The Board also completes an annual self-assessment during which it reviews its leadership and Committee structure and considers whether its structure remains appropriate in light of the Fund’s current

20

operations. The Board believes that its leadership structure, including the Chair of the Board who is an “interested person” (as defined in the 1940 Act) of the Fund, the Lead Independent Director and the current percentage of the Board who are Independent Directors is appropriate given its specific characteristics. These characteristics include: (i) the extensive oversight provided by the Fund’s adviser, the Manager, over the unaffiliated subadvisers that conduct the day-to-day management of most Portfolios of the Fund; (ii) the extent to which the work of the Board is conducted through the standing Committees, each of which is chaired by an Independent Director; (iii) the extent to which the Independent Directors meet as needed, together with their independent legal counsel, in the absence of members of management and members of the Board who are “interested persons” of the Fund; and (iv) Ms. Forget’s additional

19

roles as Chief Executive Officer of the Manager and a senior executive at MetLife with responsibility for the fund selection in MetLife’s variable insurance products, which enhance the Board’s understanding of the operations of the Manager and the role played by the Fund in MetLife’s variable products.

Other Board Considerations

The Board considered the nomination and election of persons to serve as Board members as part of an overall plan to coordinate and enhance the efficiency of the governance of the Fund with other mutual funds in the MetLife Funds Complex. In its deliberations, the Board examined various matters related to the management and long-term welfare of each Portfolio and the Fund overall, including the following:

The potential for more effective oversight that may result from generally having substantially similar boards responsible for the oversight of all of the mutual funds in the MetLife Funds Complex.

The opportunity to fill vacancies in the Board that are expected to result from the retirement of Directors in upcoming months with capable, experienced New Nominees who are familiar with the operations of the MetLife Funds Complex and the mutual fund industry generally.

The expected independent status of the New Nominees. If elected, all New Nominees are expected to qualify as Independent Directors of the Fund.

The diversity and experience of the Nominees that would comprise the expanded board. The Board noted that the Nominees have distinguished careers, including in law, finance and accounting, and would bring a wide range of expertise to the Board. In addition, all Nominees have experience as board members overseeing the Fund and/or other portfolios in the MetLife Funds Complex.

Portfolio manager, chief compliance officer and other management resources committed to Board meetings. Many officers for the Portfolios also act as officers for the MIST Portfolios. A substantially similar board would eliminate the need for the officers and key personnel of the Manager to prepare for and attend duplicative meetings, allowing such personnel more time to focus on overseeing the Fund’s operations.

21

Directors Fees

The officers and Directors of the Fund who are officers or employees of MetLife and/or its affiliates (including the Manager and MetLife Investors Distribution Company (the “Distributor”) but not affiliates of MetLife that are registered investment companies) or any subadviser of the Fund receive no compensation from the Fund for their services as officers or Directors of the Fund, although they may receive compensation from MetLife or any affiliate thereof for services rendered in those or other capacities.

20

Each Director who is not currently an active employee of MetLife or its affiliates for serving in all capacities receives, an aggregate retainer fee at the annual rate of $110,000, plus attendance fees of $15,000 for each Directors’ meeting attended. The chair of the Audit Committee, the chair of the Governance Committee and the Nominating Committee, and the chair of each of the Contract Review Committees each receives an aggregate fee of $5,000 for each full calendar year during which he/she serves as such chair. The lead Independent Director of the Fund, Mr. Garban, who was appointed to such position on February 5, 2004, receives an additional aggregate annual retainer fee of $10,000. These fees are allocated among the Portfolios based on a formula that takes into account, among other factors, the net assets of each Portfolio.

The Fund provides no pension or retirement benefits to Directors.

The following table sets forth information regarding compensation received by the Directors of the Fund who are not currently employees of MetLife or its affiliates for the year ended December 31, 2010.

Name of Director | Aggregate Compensation From Fund(1) | Total Compensation From Fund and Fund Complex Paid to Directors | ||||||

Independent Directors | ||||||||

Steve A. Garban | $ | 181,000 | $ | 181,000 | ||||

Nancy Hawthorne | $ | 177,250 | $ | 177,250 | ||||

John T. Ludes | $ | 177,250 | $ | 177,250 | ||||

Keith M. Schappert | $ | 173,500 | $ | 173,500 | ||||

Michael S. Scott Morton | $ | 177,250 | $ | 177,250 | ||||

Linda B. Strumpf | $ | 177,250 | $ | 177,250 | ||||

Dawn M. Vroegop | $ | 173,500 | $ | 378,500 | ||||

Interested Director | ||||||||

Arthur G. Typermass | $ | 161,500 | $ | 161,500 | ||||

Name, Position | Aggregate Compensation From Fund(1) | Total Compensation From Fund and Fund Complex Paid to Directors | ||||||

Independent Directors | ||||||||

Steve A. Garban, Director | $ | 181,000 | $ | 181,000 | ||||

Nancy Hawthorne, Director | $ | 177,250 | $ | 177,250 | ||||

John T. Ludes, Director | $ | 177,250 | $ | 177,250 | ||||

Keith M. Schappert, Director | $ | 173,500 | $ | 173,500 | ||||

Michael S. Scott Morton, Director | $ | 177,250 | $ | 177,250 | ||||

Linda B. Strumpf, Director | $ | 177,250 | $ | 177,250 | ||||

Dawn M. Vroegop, Director | $ | 173,500 | $ | 378,500 | (2) | |||

Interested Director | ||||||||

Arthur G. Typermass, Director | $ | 161,500 | $ | 161,500 | ||||

| (1) | The Fund has adopted a Deferred Fee Agreement (the “Agreement”). The Agreement enables participating Independent Directors to align their interests with those of the Portfolios and the Portfolios’ shareholders without having to purchase one of the variable life insurance policies or variable annuity contracts through which the Portfolios of the Fund are offered. The Agreement provides each Independent Director with the option to defer payment of all or part of the |

22

| fees payable for such Director’s services and thereby to share in the experience along-side Fund shareholders as any compensation deferred by a participating Independent Director will increase or decrease depending on the investment performance of the Portfolios on which such Director’s deferral account is based. Deferred amounts remain in the Fund until distributed in accordance with the provisions of the Agreement. The value of a participating Director’s deferral account is based on theoretical investments of deferred amounts, on the normal payment dates, in certain portfolios of the Fund or MIST as designated by the participating Director. Pursuant to the Agreement, payments due under the |

21

| Agreement are unsecured obligations of the Fund. Certain Directors have elected to defer all or part of their total compensation for the year ended December 31, 2010. As of December 31, 2010, Messrs. Garban, Scott Morton and Typermass and Ms. Hawthorne had accrued $59,730, $32,000, $64,600 and $17,725, respectively, in the Fund, under the Agreement. Ms. Vroegop had accrued $58,350 in the MetLife Funds Complex as a whole, including $17,350 in the Fund. The deferral amounts are included above, as applicable. |

| (2) | Ms. Vroegop also serves as a Trustee for 54 MIST Portfolios. |

Nominee and Director Beneficial Ownership

The following table states the dollar range of equity securities beneficially owned by each Nominee and Director in the Portfolios of the Fund, the MIST Portfolios and the MetLife Funds Complex.

Name of Director | Name of Portfolio | Dollar Range of Equity Securities in the Portfolio | Dollar Range of Equity Securities in the MetLife Funds Complex | |||

Nominees | ||||||

Stephen M. Alderman | MetLife Moderate Strategy Portfolio | Over $100,000(2) | Over $100,000 | |||

| PIMCO Inflation Protected Bond Portfolio | $10,001 - $50,000(2) | |||||

Robert Boulware | American Funds Bond Portfolio | Over $100,000(1) | Over $100,000 | |||

Daniel A. Doyle | Clarion Global Real Estate Portfolio | $10,001 - $50,000(2) | Over $100,000 | |||

| PIMCO Total Return Portfolio | $10,001 - $50,000(2) | |||||

| Third Avenue Small Cap Value Portfolio | $10,001 - $50,000(2) | |||||

| American Funds Growth Portfolio | Over $100,000(2) | |||||

23

Name of Director | Name of Portfolio | Dollar Range of Equity Securities in the Portfolio | Dollar Range of Equity Securities in the MetLife Funds Complex | |||

Susan C. Gause | PIMCO Total Return Portfolio | Over $100,000(1) | Over $100,000 | |||

| Harris Oakmark International Portfolio | $10,001 - $50,000(2) | |||||

| PIMCO Inflation Protected Bond Portfolio | $1 - $10,000(2) | |||||

| T. Rowe Price Mid Cap Growth Portfolio | $1 - $10,000(2) | |||||

| Van Eck Global Natural Resources Portfolio | $1 - $10,000(2) |

22

|

| |||||

Nancy Hawthorne | T.Rowe Price Large Cap Growth Portfolio | $10,001 - $50,000(1) | $50,001 -$100,000 | |||

| T.Rowe Price Small Cap Growth Portfolio | $10,001 - $50,000(1) | |||||

Linda B. Strumpf | BlackRock Strategic Value Portfolio | $10,001 - $50,000(1) | Over $100,000 | |||

| Davis Venture Value Portfolio | $10,001 - $50,000(1) | |||||

| Jennison Growth Portfolio | $10,001 - $50,000(1) | |||||

| T.Rowe Price Small Cap Growth Portfolio | $10,001 - $50,000(1) | |||||

| Van Eck Global Natural Resources Portfolio | $10,001 - $50,000(1) | |||||

Dawn M. Vroegop | Loomis Sayles Global Markets Portfolio | $10,001 - $50,000(1) | Over $100,000 | |||

| Met/Franklin Templeton Founding Strategy Portfolio | $10,001 - $50,000(1) | |||||

| PIMCO Total Return Portfolio | $10,001 - $50,000(1) | |||||

| Davis Venture Value Portfolio | $1 - $10,000(1) | |||||

| Met/Dimensional International Small Company Portfolio | $1 - $10,000(1) | |||||

| MFS Total Return Portfolio | $10,001 - $50,000(1) | |||||

| Van Eck Global Natural Resources Portfolio | $1 - $10,000(1) | |||||

2324

Name of Director | Name of Portfolio | Dollar Range of Equity Securities in the Portfolio | Dollar Range of Equity Securities in the MetLife Funds Complex | |||

Independent Directors | ||||||

Steve A. Garban | Artio International Stock Portfolio | $10,001 - $50,000(1) | Over $100,000 | |||

| Davis Venture Value Portfolio | $10,001 - $50,000(1) | |||||

| Met/Artisan Mid Cap Value Portfolio | $50,001 - $100,000(1) | |||||

| T.Rowe Price Large Cap Growth Portfolio | $10,001 - $50,000(1) | |||||

Michael S. Scott Morton | Artio International Stock Portfolio | $10,001 - $50,000(1) | $50,001 - $100,000 | |||

| Davis Venture Value Portfolio | $10,001 - $50,000(1) | |||||

| Loomis Sayles Small Cap Portfolio | $10,001 - $50,000(1) | |||||

| Neuberger Berman Mid Cap Value Portfolio | $10,001 - $50,000(1) | |||||

Interested Directors | ||||||

Elizabeth M. Forget | MetLife Growth Strategy Portfolio | $10,001 - $50,000(2) | $10,001 - $50,000 | |||

Arthur G. Typermass | BlackRock Money Market Portfolio | $50,001 - $100,000(1) | Over $100,000 | |||

| Jennison Growth Portfolio | $10,001 - $50,000(1) | |||||

| Neuberger Berman Mid Cap Value Portfolio | $50,001 - $100,000(1) | |||||

| T.Rowe Price Large Cap Growth Portfolio | $10,001 - $50,000(1) | |||||

| BlackRock Aggressive Growth Portfolio | $50,001 - $100,000(2) | |||||

| Artio International Stock Portfolio | $10,001 - $50,000(2) | |||||

| MetLife Stock Index Portfolio | Over $100,000(2) | |||||

2425

| (1) | Represents ownership, as of September 30, 2011, in each Portfolio or MIST Portfolio held through the Fund’s or MIST’s respective Deferred Compensation Plan. The Fund’s Deferred Compensation Plan is discussed above. |

| (2) | Represents ownership, as of November 30, 2011, of insurance products that utilize the Fund or MIST as an investment vehicle. Shares of the Fund and MIST may not be held directly by individuals. |

Except for insurance products issued by affiliates of the Manager, that may be held by family members of Nominees, to the knowledge of the Fund, as of September 30, 2011, neither the Independent Directors, the New Nominees, or their immediate family members owned beneficially or of record securities of the Manager, a subadviser, a principal underwriter or sponsoring insurance company of the Fund or a person (other than a registered investment company) directly or indirectly controlling, controlled by, or under common control with an investment adviser, subadviser, principal underwriter or sponsoring insurance company of the Fund.

Shareholder Communication with the Board of Directors

The Fund has adopted procedures by which Contract Owners may send communications to the Board. These communications should be sent to the attention of the Board or the specific Director to whom the communication is directed at Metropolitan Series Fund, Inc., c/o Secretary, 501 Boylston Street, Boston, MA 02116.

A communication must (i) be in writing and be signed by the Contract Owner, (ii) identify the specific Portfolio, if any, of the Fund to which it relates and (iii) identify the number of units held by the Contract Owner that relate to shares of a Portfolio of the Fund.

These procedures do not apply to (i) any communication from an officer or Director of the Fund, (ii) any communication from an employee or agent of the Fund, unless such communication is made solely in such employee’s or agent’s capacity as a Contract Owner or (iii) any shareholder proposal submitted pursuant to Rule 14a-8 under the Exchange Act or any communication made in connection with such a proposal.

Vote Required

Shareholders of all Portfolios of the Fund vote together as a single class on the election of Directors. The Nominees receiving the affirmative vote of a plurality of the votes cast in person or by proxy at the Meeting, if a quorum is present, shall be elected.

Recommendation of the Board

The Board of Directors believes that the election of each Nominee is in the best interests of shareholders of the Fund. Accordingly, the Board unanimously recommends that shareholders vote FOR the election of each Nominee as set forth in Proposal I.

2526

PROPOSAL II – APPROVAL OF AMENDED AND RESTATED ADVISORY AGREEMENT

Introduction

The Board recommends that shareholders of each Portfolio approve an Amended Advisory Agreement with the Manager, the terms of which reflect that each Portfolio may retain, at its expense, a third-party administrator to provide administrative services to the Portfolio and that the Manager’s role in respect of those administrative services will be limited to supervising and overseeing them (such amendments, the “Administration-Related Amendments”). Under each Portfolio’s existing advisory agreement or investment management agreement with the Manager (each, an “Existing Advisory Agreement”), the Manager provides both advisory and administrative services to the Fund. In connection with a recent review of the operations of the MetLife Funds Complex, the Manager reviewed the administrative services required by the Fund and evaluated whether those services could be provided in a more efficient and effective manner, including, potentially, by parties other than the Manager. Due to the increasing complexity of the operations of mutual funds, including the increased and evolving regulatory burdens placed on mutual funds, a number of similarly situated fund families have retained the services of third-party service providers that specialize in providing administrative services to mutual fund complexes. Service providers that focus on providing administrative services to a number of different mutual fund families have certain advantages that generally allow them to provide administrative services more efficiently than others, like the Manager, who provide administrative services to a limited group of proprietary funds. This is because of, among other things, the significant ongoing capital investments required to provide high-quality administrative services and the scalability of a business that provides such services to a number of different mutual fund families (as opposed to a limited number of proprietary funds). After the completion of its review of the Fund’s need for administrative services, the Manager concluded that the Fund could benefit over the long term from the retention of a third-party administrator dedicated to the business of providing administrative services to mutual fund families.

The Manager previously considered a range of service providers engaged in the business of providing administrative services to mutual funds in connection with the retention of a third-party administrative service provider on behalf of the MIST Portfolios in 2001. Based on, among other things, (i) the Manager’s past review of the capabilities of those service providers, including, among other things, the quality of their respective services, the depth of their experience, expertise and available resources, their investment in the systems and technology required to provide modern administrative services efficiently and their proposed fees and (ii) the Manager’s experience working with the third-party administrator to the MIST Portfolios, the Manager determined to recommend that the Board approve the Amended Advisory Agreement for each Portfolio and, at a future date, retain a third-party administrator (the “Administrator”) to provide administrative services to the Portfolios pursuant to an administrative services agreement (the “Administrative Services Agreement”).

2627

At the November Meeting, the Manager proposed to the Board that each Portfolio’s Existing Advisory Agreement be amended to revise the terms of that Agreement to reflect, among other things, that the Fund may retain a third party to perform administrative services for each Portfolio at the Portfolio’s expense, and to limit the Manager’s role in respect of those administrative services to supervising and overseeing them. The tasks the Administrator would be expected to perform under the proposed arrangements, include, among other things, preparing annual and semi-annual reports and other periodic filings with the Securities and Exchange Commission (“SEC”), calculating portfolio performance, informing Fund officers of any new accounting pronouncements and regulatory updates, preparing financial reports for quarterly Board meetings, performing certain portfolio compliance tasks, such as monitoring leverage and preparing Fund tax returns, and maintaining Fund records.

In addition, with respect to the Barclays Capital Aggregate Bond Index Portfolio, Loomis Sayles Small Cap Growth Portfolio, MetLife Mid Cap Stock Index Portfolio, MetLife Stock Index Portfolio, MFS Value Portfolio, Morgan Stanley EAFE Index Portfolio, Neuberger Berman Mid Cap Value Portfolio, Oppenheimer Global Equity Portfolio, Russell 2000 Index Portfolio, T. Rowe Price Large Cap Growth Portfolio and T. Rowe Price Small Cap Growth Portfolio only (collectively, the “Group A Portfolios”), the Amended Advisory Agreement includes amendments to the Group A Portfolios’ Existing Advisory Agreements designed to (i) modernize the terms of the Group A Portfolios’ Existing Advisory Agreements and (ii) align the terms of the Group A Portfolios’ Existing Advisory Agreements with those of the advisory agreements of the remaining twenty-three Portfolios of the Fund (the “Group B Portfolios”).

The Group A Portfolios’ Existing Advisory Agreements were established before the Manager began to employ a manager-of-managers structure, on behalf of the Portfolios, to retain leaders in the investment advisory field to provide investment advice to the Portfolios. As a result, although the Group A Portfolios are managed utilizing a manager-of-managers structure, the Group A Portfolios’ Existing Advisory Agreements do not expressly address certain issues relevant to the manager-of-managers structure that the Group B Portfolios’ Existing Advisory Agreements do address. For example, the Group B Portfolios’ Existing Advisory Agreements explicitly require the Manager to perform certain duties that are integral to the manager-of-managers structure, such as supervising and overseeing the services provided to a Portfolio by a subadviser. The Group A Portfolios’ Existing Advisory Agreements do not have a similar provision. Accordingly, at the November Meeting, the Manager proposed that, in addition to the Administration-Related Amendments, the Group A Portfolios’ Existing Advisory Agreements be amended and restated to modernize and align their terms with those of the Group B Portfolios’ Existing Advisory Agreements. A summary description of differences between the Group A Portfolios’ Existing Advisory Agreements and the Amended Advisory Agreement may be found below.

2728

Proposal II, if approved, may affect the profitability of the Manager because the Manager will no longer provide certain administrative services to the Portfolios and incur related expenses. TheAlthough the Manager expects to continue to incur costs relating to the provision of non-advisory services to the Portfolios, including in connection with the supervision and oversight of the services provided by a third-party administrator, the Manager estimates that it may experience annual savings of approximately $300,000 if Proposal II is approved and a third-party administrator is retained.

Certain Directors and certain officers of the Fund may be owners of shares of MetLife or its affiliates and may indirectly benefit if a Portfolio’s shareholders approve the Amended Advisory Agreement. Similarly, the Insurance Companies may also benefit indirectly from such change.

Although the Fund anticipates retaining a third-party administrator at a future date, the Fund may not retain a third-party administrator until some time after the Amended Advisory Agreement, if approved, goes into effect. If the Fund has not retained a third-party administrator when the Amended Advisory Agreement goes into effect, the Fund expects to enter into an interim administrative services agreement with the Manager until the Fund retains a third-party administrator. Under any interim administrative services agreement with the Manager, it is not expected that the Manager would be paid any additional compensation.

The Board reserves the right not to implement the Amended Advisory Agreement in respect of any Portfolio or all Portfolios or not to retain a third-party administrator in respect of any Portfolio or all Portfolios if it determines doing so is not in a Portfolio’s or the Portfolios’ best interests, including if not all of the Portfolios approve Proposal II.

Board Considerations

At the November Meeting, the Directors, including all of the Independent Directors, determined to approve the Amended Advisory Agreement on behalf of each Portfolio and to call a meeting of shareholders of the Portfolios so shareholders of the Portfolios could consider approving the Amended Advisory Agreement on behalf of their respective Portfolio. Prior to making these conclusions, the Board of Directors considered a wide range of information of the type they regularly consider when determining whether to continue the Portfolios’ advisory agreements.agreements, including the relative performance of the Portfolios and the advisory fees paid by other similar funds. In doing so, the Directors did not identify any single factor as determinative but took into account a number of factors.

The Directors considered the nature, extent and quality of the services expected to be provided to the Portfolios by the Manager and the Administrator. In this regard, the Directors considered presentations by Fund officers and representatives of the Manager. The Directors noted that the investment advisory services provided by the Manager and the fees payable to the Manager were not proposed to change. The Directors considered the Manager’s continuing obligation to provide certain non-advisory services, including

29

the supervision and oversight of the services provided by the Administrator, and the substantial costs it would incur in doing so.

28

The Directors noted representations from the Manager that its staffing requirements would not materially decrease if the Amended Advisory Agreement were approved and that, with limited exceptions, the Manager’s staff currently dedicated to providing the Fund with administrative services would generally be repurposed and would supervise and oversee the administrative services provided by the Administrator to the Fund. The Directors considered that the repurposing of the Manager’s staff may enhance the supervision of the administrative services provided by the Administrator to the Portfolios.

The Directors also considered information provided to them regarding services the Administrator would likely provide (collectively, the “Administrator Information”). The Administrator Information provided information that assisted the Directors in assessing the likely quality of the administrative services that were expected to be provided by the Administrator and the Manager’s ability to oversee and supervise the provision of services by the Administrator.